When diving into real estate investing, you’ll often hear about “cap rates.” But what exactly are cap rates, and why do they matter? Let’s break it down in simple terms. This guide will help you understand the basics, even if you’re new to investing. We will understand what a Cap Rate is, how to calculate it, what affects it and hot to interpret it, the connection between interest rates and cap rates, how to use it in REIT investing context, and where to find cap rate data.

What is a Cap Rate?

Let’s start with the basics. Cap rate is short for capitalization rate. It’s a key metric in real estate investing. Cap rates help investors evaluate potential property purchases. They also allow comparisons between different properties.

At its core, a cap rate is a measure of return on investment. It shows how much income a property generates compared to its value. Investors use cap rates to estimate how quickly they might recoup their investment.

How to Calculate Cap Rates

The formula for calculating a cap rate is simple:

Cap Rate = Net Operating Income (NOI) / Purchase Price

Let’s break this down:

- Net Operating Income (NOI) is the income a property generates after all operating expenses, like maintenance and property taxes, are deducted.

- Purchase Price is the current market value or purchase price of the property.

To get the cap rate, divide the NOI by the property value. Then multiply by 100 to express it as a percentage.

For example, let’s say a property has an NOI of $50,000 and is valued at $1,000,000. The cap rate would be:

($50,000 / $1,000,000) x 100 = 5%

This property has a 5% cap rate.

This 5% cap rate means the property is expected to generate a 5% return on the purchase price each year, without leverage.

Here, try to change the income and the value of the property to see how it affects the cap rate:

Why Cap Rates Matter

Cap rates are crucial for several reasons:

- Quick Comparison: They allow fast comparisons between properties.

- Risk Assessment: Higher cap rates often mean higher risk, but also higher potential returns.

- Market Insights: Cap rates can indicate overall market conditions.

- Investment Strategy: They help investors choose properties that align with their goals.

Factors That Influence Cap Rates

Cap rates aren’t the same across all properties. Several factors can affect them:

- Interest Rates: When interest rates rise, cap rates often follow. Due to its importance, we’ll describe the connection between cap rates and interest rates in a stand-alone paragraph.

- Location Location plays a huge role in determining cap rates. Properties in popular, high-demand areas often have lower cap rates. This is because they’re seen as safer, more stable investments. On the other hand, properties in less desirable areas might offer higher cap rates, reflecting higher potential returns but also higher risk.

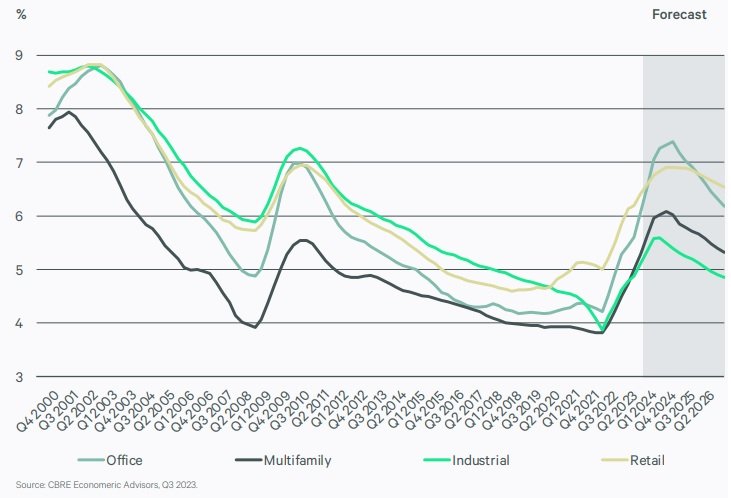

- Property Type Different types of properties, like residential, commercial, and industrial, can have different cap rates. For instance, commercial properties might have higher cap rates compared to residential properties. This is due to the varying levels of risk and potential income associated with each type.

- Market Conditions The broader economy and current market trends can also impact cap rates. During a booming economy, cap rates might be lower because property values are higher and perceived risks are lower. In a downturn, cap rates could rise as property values drop and risks increase. Cap rates also reflect market expectations about rent trends. For instance, if the standard cap rate for similar properties is 5% and a property costs $1,000,000, the market rent should be around $50,000. However, if the current rent is $60,000, the calculated cap rate would be 6%. This higher cap rate might not reflect the true yield, as rents are expected to decrease. As the rents drop, the cap rate would also decrease to align with the market rate of 5%.

- Property Age and Condition: Newer or well-maintained properties often have lower cap rates.

- Tenant Quality: Stable, long-term tenants can lower cap rates.

How to Interpret Cap Rates

So, what’s a good cap rate? A higher cap rate generally indicates a higher risk premium, meaning investors expect a greater return to compensate for increased risk. This often occurs in markets or properties with more uncertainty, such as those in less stable locations or with potential management challenges. This higher risk can mean potential for higher returns, but also a greater chance of things not going as planned. Conversely, a lower cap rate suggests lower risk, where investors are willing to accept smaller returns because the property or market is seen as more stable and reliable. This lower cap rate reflects a safer investment with less risk involved. It’s a trade-off between risk and reward. So, what’s considered low and what’s high? As a general rule, which is applicable to developed markets:

- Low Cap Rate (4-5%): Usually found in prime locations or high-demand areas. These properties are considered lower risk but offer lower returns.

- Medium Cap Rate (6-8%): Often seen in balanced markets. These offer a mix of stability and returns.

- High Cap Rate (9%+): Typically found in riskier investments or emerging markets. These offer higher potential returns but come with more risk.

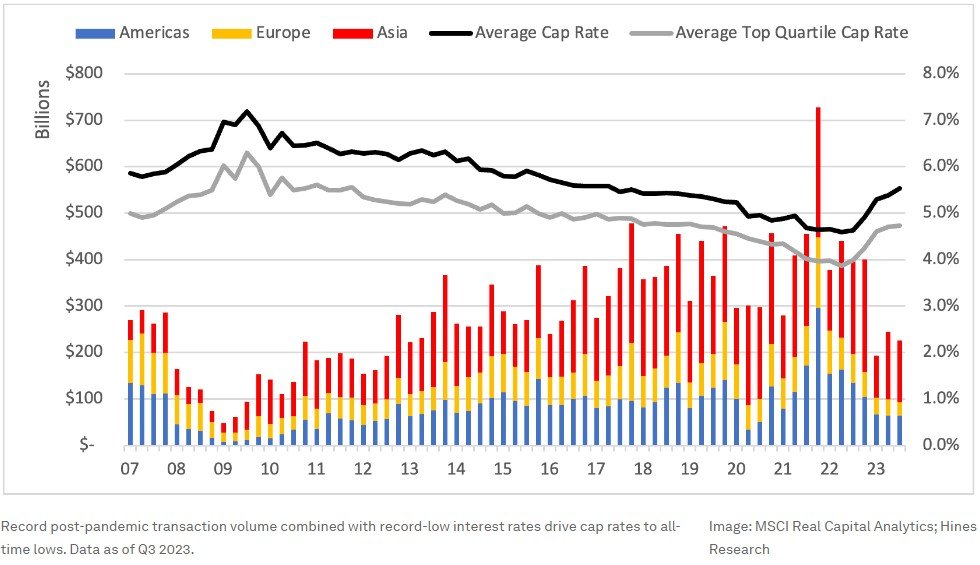

For context, here are charts of historic cap rates for various property types in the US, and world averages:

Cap Rates and Interest Rates

Cap rates and interest rates are often thought to be closely linked in the real estate market. Conventional wisdom suggests that when interest rates rise, cap rates should follow. This theory is based on two main factors. First, higher interest rates increase borrowing costs, potentially making real estate investments more expensive and thus pushing cap rates up. Second, rising interest rates can make alternative investments, like bonds, more attractive, leading investors to demand higher returns from real estate to remain competitive.

However, the relationship between cap rates and interest rates is more complex than it might initially appear. Cap rates can be broken down into two components: the risk-free rate (typically based on government bond yields) and a risk premium (the additional return investors demand for real estate risks). While changes in interest rates directly affect the risk-free rate, they don’t necessarily impact the risk premium in a predictable way.

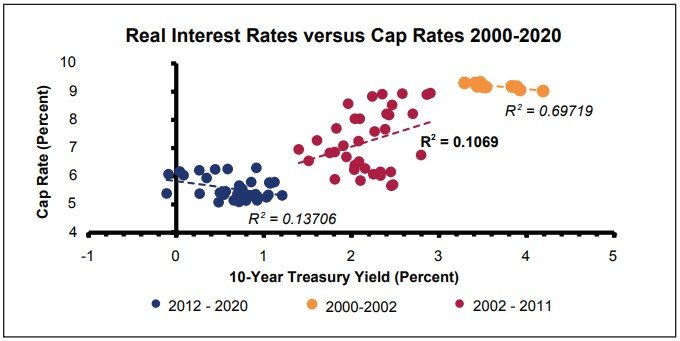

Interestingly, empirical data challenges the notion of a strong, consistent connection between cap rates and interest rates. When researchers divide historical data into distinct periods, they often find that the correlation is weaker than expected:

- Chart from The Linneman Letter, Volume 20, Issue 3- Fall 2020

- https://www.luzernassoc.com/wp-content/uploads/2020/10/2020-Fall-Linneman-Letter.pdf

We see that the correlation in the periods 2002-2011 and 2012-2020 is very low, as expressed by the low R-Squared parameter (in finance, R-Squared above 0.7 is usually considered a high level of correlation, and below 0.4 as low correlation).

This suggests that other factors may play a more significant role in driving cap rate movements.

One crucial factor that has emerged as a stronger predictor of cap rate movements is the flow of mortgage funds. Changes in the availability and terms of mortgage financing can have a substantial impact on real estate demand and, consequently, on cap rates. When mortgage funds are plentiful and easily accessible, it can increase demand for real estate, potentially leading to lower cap rates. Conversely, when mortgage funds are scarce or lending standards tighten, it can reduce demand and push cap rates higher.

While interest rates certainly play a role in shaping cap rates, their influence should not be overstated. Investors should consider the broader economic and market context when analyzing cap rate trends and making investment decisions.

Using Cap Rates in Decision-Making

Cap rates are a useful tool, but they shouldn’t be the only factor in your decision-making process. Here’s how to use them effectively:

Comparing Investments Use cap rates to compare different properties quickly. If you’re looking at several options, cap rates can help you see which one might offer the best return for your investment. If the property you’re considering shows a different cap rate from other properties, it’s important to understand why.

Historical comparison Understanding the historical range of cap rates is crucial for assessing the potential volatility of your asset. For example, if the historical cap rates for residential properties in your area have ranged from 4% to 5.5%, this gives you a sense of how property values might fluctuate. Suppose your property generates $100,000 in annual rent. Based on these historical cap rates, the property’s value could vary between $2,500,000 and $1,818,181. Therefore, if you purchase the property at a 4% cap rate, be aware that its value might decrease by up to 27% if the cap rate moves toward the higher end of the historical range.

Cap Rates and REITs

Cap rates are vital in analyzing Real Estate Investment Trusts (REITs). Investors use them to compare REITs to direct property investments. They also help assess if a REIT is trading at a premium or discount. This comparison can reveal potential investment opportunities.

To do this, investors compare two key figures. First, they look at the REIT’s implied cap rate. This is based on its stock price and net operating income. Then, they compare it to market cap rates for similar properties. This process helps investors gauge the REIT’s relative value.

Here’s an example. Let’s say a REIT focuses on office buildings in big cities. The market cap is $1 billion, and the REIT has $1 billion in debt. It also generates $100 million in net operating income (NOI) so its implied cap rate would be 5% ($100 million / $2 billion). But similar office properties in those markets trade at 4.5% cap rates. This might suggest the REIT is undervalued. Investors might see this as a buying opportunity.

Investors also use cap rates to compare REITs in the same asset class. Take two REITs that specialize in suburban apartments. REIT A has an implied cap rate of 5.5%. REIT B’s is 6%. Investors would try to understand this difference. It could be due to mispricing in the market, but also due to property quality, management skills, or growth potential. These factors can affect the REIT’s performance and risk profile.

So, cap rates are useful for REIT analysis. But they’re just one piece of the puzzle. Investors should look at other financial and qualitative factors too. This approach gives a fuller picture of a REIT’s value and potential. It helps investors make more informed decisions about REIT investments.

Remember, the real estate market is complex. Cap rates provide valuable insights, but they don’t tell the whole story. Smart investors use them as a starting point for deeper analysis. This comprehensive approach can lead to better investment choices in the REIT market.

Where to Find Cap Rate Data?

Commercial real estate firms often publish market reports. These include average cap rates for different property types and locations. Companies like CBRE, JLL, and Cushman & Wakefield offer these reports. For example, CBRE publishes a half-yearly cap rate survey report for various geographies and property classes, which you can easily find with Google.

Real estate data providers are another good source. CoStar, Real Capital Analytics, and Reis provide detailed cap rate information. However, these services often require paid subscriptions.

Nareit, the National Association of Real Estate Investment Trusts, publishes the Nareit T-Tracker, a report which includes the implied cap rate of public REITs by different property sectors:

Local real estate associations sometimes publish market data. This can include cap rate information for specific areas.

Government agencies also offer useful data. The National Council of Real Estate Investment Fiduciaries (NCREIF) provides quarterly property index returns. These can be used to calculate cap rates.

Lastly, networking with local real estate professionals can provide valuable insights. Brokers, appraisers, and other investors often have access to recent transaction data.

Conclusion

Cap rates are a valuable tool for real estate investors. They offer a quick way to compare properties and assess potential returns. However, they’re not perfect. Cap rates have limitations and should be used alongside other metrics.

Remember these key points:

- Cap rates measure a property’s annual return relative to its value.

- They’re influenced by factors like location, property type, and market conditions.

- Lower cap rates often mean lower risk, while higher cap rates suggest higher risk and potential returns.

- Use cap rates as part of a broader analysis, not as your sole decision-making tool.

As you continue your real estate investing journey, cap rates will be a crucial concept to understand. They’ll help you evaluate opportunities and make informed decisions.

Disclaimer: The information provided in this post is for informational purposes only and reflects my personal opinions. It should not be considered as professional financial, legal, or investment advice. Please consult with a professional before making any investment decisions. I am not responsible for any actions taken based on this information. For more details, please refer to our full disclaimer.