- Why Calculate REIT Leverage?

- Methods for Calculating REIT Leverage

- How CFOs Measure Leverage

- Understanding Balance Sheet Values: US GAAP vs. IFRS

- How Credit Rating Agencies View REIT Leverage

- Academic Perspectives on REIT Leverage

- EPRA Guidelines on Measuring REIT Leverage

- REIT Leverage Constraints

- Summary of Key Points on Measuring REIT Leverage

Calculating leverage serves different purposes depending on the perspective. Debt holders use it to assess the risk of default and the REIT’s ability to cover its obligations, while equity holders use it to gauge potential returns and financial risk. Calculating leverage ratio helps in understanding these perspectives effectively. Leverage affects the risk profile, return potential, cost of equity, and long-term stability of a REIT. In this article, we’ll explore how to measure REIT leverage, different calculation methods, and why understanding these metrics is crucial for making informed investment decisions. We’ll review company reports, academic research, and credit rating agency assessments to provide a comprehensive understanding of leverage measurement in REITs.

Why Calculate REIT Leverage?

Leverage in REITs refers to the amount of debt used to finance their asset portfolio relative to their equity or assets. Measuring REIT leverage is crucial for several reasons:

- Debt Holders: Debt holders use leverage to assess a REIT’s ability to manage debt and understand the associated risks. Higher leverage increases the risk that asset values may fall below the debt amount, raising the likelihood of default. During economic downturns, high leverage can indicate significant risk, as the REIT may face challenges in maintaining asset values or servicing its debt obligations.

- Equity Holders: For shareholders, leverage reveals how much of the REIT’s assets are financed by debt versus equity. Calculating leverage ratio for equity holders helps in understanding the balance between risk and potential returns. This affects both the potential returns and the cost of equity. Higher leverage amplifies returns during favorable market conditions but also increases risks during downturns. As leverage rises, equity holders require higher returns to compensate for the increased risk.

Since the likelihood and possible magnitude of asset value fluctuations depend heavily on the type of assets and their geographic location, leverage should ideally be compared between companies that operate within similar asset classes. Comparing REITs within similar geographic regions is also important, as different locations have distinct risk profiles that directly impact leverage stability and risk. This approach ensures a more meaningful comparison, as different asset types (e.g., multifamily versus office properties) and locations (e.g., urban versus rural markets) have distinct risk profiles that directly impact leverage stability and risk.

Calculating leverage gives a clearer picture of a REIT’s financial health and helps compare different REITs. It assists investors in making decisions aligned with their risk tolerance and is crucial for equity valuation.

Methods for Calculating REIT Leverage

There are two main approaches to calculating REIT leverage: asset value-based leverage and operating ratios like Debt/EBITDA. Both approaches are useful for calculating leverage ratio and offer distinct insights into a REIT’s risk profile. Understanding how to calculate leverage ratio using these methods is key for effective REIT analysis:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Asset Value-Based Leverage | Uses the total value of a REIT’s assets to determine leverage, often expressed as Loan-to-Value (LTV) ratio or as Debt to Capitalization. | Incorporates the value of the underlying real estate, providing a clear picture of debt relative to asset values. | Asset values can be skewed by appraisals and may fluctuate significantly, especially in illiquid markets. Also, not all companies disclose the appraised value of their assets. |

| Operating Ratios (Debt/EBITDA) | Focuses on a REIT’s income-generating ability, showing how many years of earnings are needed to pay off debt. | Provides a clear indication of operational performance and how effectively earnings cover debt obligations. | Does not account for differences in asset risk (e.g., multifamily is less risky than office), and doesn’t directly reflect the underlying value of assets. |

Asset Value-Based Leverage: This approach calculates leverage using the total value of a REIT’s assets. It is often expressed as a Loan-to-Value (LTV) ratio or as Debt to Capitalization (Debt + Equity), which measures the debt against the market or book value of the assets. This method is useful because it incorporates the value of the underlying real estate. Since asset valuations account for the risk characteristics of the asset, this ratio reflects the differing risk profiles of various assets, providing a nuanced view of leverage.

Example of LTV Calculation: See this extract from Vonovia’s quarterly package:

As of Sep. 30, 2024, The REIT had Eur 40.1 Billion of net debt and Eur 83.8 Billion of real estate assets. This results at an LTV of 47.9%, means that 47.9% of the REIT’s property value is financed by debt, indicating the leverage level.

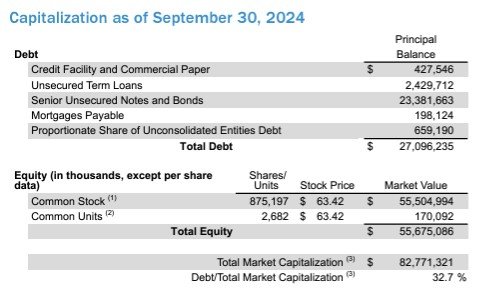

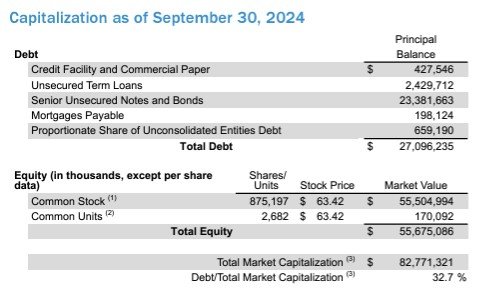

Example of Debt to Capitalization Calculation: See this extract from Realty Income Corporation’s quarterly package:

As of Sep. 30, 2024, The REIT had $ 27.1 Billion of debt and a market value of equity of $ 55.7 Billion. Together, the total capitalization was $ 82.8 Billion, resulting in debt to capitalization ratio of 32.7%. This indicates that 32.7 % of the capital structure is composed of debt. This calculation uses the market value of equity, which is known as the Market Cap-based calculation. Alternatively, in IFRS reporting companies, we can calculate this ratio using the Book value of equity, known as the Balance Sheet-based calculation. The market cap-based approach provides a real-time assessment of leverage, reflecting current investor sentiment, but can be more volatile compared to the stability offered by the Balance Sheet-based calculation.

- Difference Between LTV and Debt to Capitalization: The key difference between these two metrics is the denominator. The LTV ratio uses only the total property value, whereas the Debt to Capitalization ratio includes both debt and equity in the denominator. This means that LTV provides insight into leverage relative to the underlying assets, while Debt to Capitalization offers a view of the entire capital structure, showing the balance between debt and equity financing. The Debt to Capitalization ratio may also be influenced by items like deferred tax liabilities, which reduce the equity value. This is less important in REITs, which do not pay taxes, but relevant to other real estate holding companies. For equity holders, the ratio of Equity to Capitalization may be more relevant. If the REIT has preferred stocks, the ratio of Debt to Capitalization will not take them into account, while the Equity to Capitalization will.

- Caveat: One key limitation of asset value-based leverage is that asset values can be skewed. Market valuations may vary significantly, and assumptions by appraisers can influence reported values, especially in illiquid or fluctuating markets.

Operating Ratios (Debt/EBITDA): Operating ratios like Debt/EBITDA focus on a REIT’s income-generating ability. They show how many years of EBITDA would be required to pay off the debt. This metric is less about asset value and more about operational performance.

Example of Debt/EBITDA Calculation: Again, let’s look at this extract from Vonovia’s quarterly package:

As of Sep. 30, 2024, The REIT had Eur 40.1 Billion of net debt and Eur 2.56 Billion of EBITDA. This results at an Debt/EBITDA ratio of 15.7. This means it would take 15.7 years of EBITDA to pay off the debt, assuming no other cash outflows or debt repayments. A lower ratio typically indicates better debt-servicing ability, whereas a higher ratio could imply higher financial risk.

- Comparison to LTV Calculation: Unlike the LTV ratio, which measures leverage relative to the value of underlying assets, Debt/EBITDA provides a snapshot of the REIT’s operational cash flow in covering its debt obligations. LTV focuses on the relationship between debt and asset value, making it more useful for understanding asset-backed leverage, while Debt/EBITDA offers a direct insight into the REIT’s cash-generating capabilities relative to its debt load.

- Example Comparison: The assets of Vonovia are valued using a cap rate of about 3.1%, resulting at an LTV of 47.9%.if the assets are riskier and should be valued using a cap rate of 3.5%, their value will be Eur 74.3 Billion and the LTV ratio increases to 54%. This increase in LTV from 47.9% to 54% shows how changes in asset risk, as indicated by the cap rate, directly affect the leverage ratio. In contrast, the Debt/EBITDA ratio remains 15.7 in both scenarios, as it depends solely on the operational earnings and debt level, not the asset valuation. This distinction highlights how Asset Value-Based Leverage ratios are sensitive to changes in property valuations, while Operating Ratios are focused on the income-generating ability of the REIT, making them less reactive to shifts in asset risk.

How CFOs Measure Leverage

CFOs of REITs often have distinct approaches to measuring leverage based on the accounting standards they follow and their strategic priorities. In IFRS reporting, CFOs tend to use book values for leverage calculations, primarily because book values are less volatile than market values. They also place considerable trust in the appraisers who evaluate the fair value of assets, which provides a stable basis for leverage assessment. This reliance on book values helps maintain consistency in financial reporting and mitigates the effects of market fluctuations.

In contrast, CFOs of REITs that report under US GAAP often focus on Debt/EBITDA as a key leverage metric. This preference arises because US GAAP requires assets to be reported at historical cost, making the book value less reflective of current market conditions. Debt/EBITDA relies on financial reporting items that are more stable and less influenced by market volatility compared to market-based asset valuations. This approach helps CFOs provide a clearer view of operational leverage and the REIT’s ability to service its debt obligations.

Understanding Balance Sheet Values: US GAAP vs. IFRS

The accounting standards that a REIT follows significantly affect how leverage is calculated:

- US GAAP: Under US GAAP, assets are reported at historical cost, which means their book value does not reflect the true market value. Since the book value is often outdated, leverage calculations for US GAAP REITs depend heavily on market capitalization to approximate asset values. The challenge here is that market cap fluctuates significantly, which can make leverage metrics volatile.

- IFRS: IFRS mandates fair value accounting for real estate assets, allowing for more current valuations on the balance sheet. This provides two indicators for asset values—one derived from the market price of equity and the other from the balance sheet.

- Market Cap-Based Calculation: Using the market cap to derive asset value has advantages, such as being reflective of current market sentiment. However, it can also be volatile, especially during periods of market uncertainty.

- Balance Sheet-Based Calculation: Using balance sheet values provides stability and consistency, as fair values are typically updated annually or semi-annually by trusted appraisers. This approach is generally preferred by CFOs as it avoids the day-to-day fluctuations seen in the market.

Following is a comparison of the leverage ratios that REITs that use different financial reporting standards use:

| Company Name | Real Estate Sector | Incorporation | Accounting Standard | Leverage Metrics Used |

|---|---|---|---|---|

| Prologis | Industrial | U.S. | U.S. GAAP | Debt/Total Market Capitalization, Debt/Gross Asset Value, Debt/EBITDA |

| Realty Income | Retail | U.S. | U.S. GAAP | Debt/Total Market Capitalization |

| Simon Property Group | Retail | U.S. | U.S. GAAP | Debt/Total Assets, Assets calculated as NOI/7% plus cost of other assets |

| Avalon Bay | Residential | U.S. | U.S. GAAP | Debt/EBITDA |

| Equity Residential | Residential | U.S. | U.S. GAAP | Debt/EBITDA, Debt/Total Market Capitalization |

| Ventas | Healthcare | U.S. | U.S. GAAP | Debt/EBITDA, Debt/Total Market Capitalization |

| Alexandria Real Estate | Office | U.S. | U.S. GAAP | Debt/EBITDA |

| Invitation Homes | Residential | U.S. | U.S. GAAP | Debt/EBITDA |

| Vonovia | Residential | Europe | IFRS | LTV, Debt/EBITDA |

| SEGRO | Industrial | Europe | IFRS | LTV, Debt/EBITDA |

| Unibail-Rodamco-Westfield | Retail | Europe | IFRS | LTV, Debt/EBITDA |

| Akelius Residential Property | Residential | Europe | IFRS | LTV, Debt/EBITDA |

| Klépierre | Retail | Europe | IFRS | LTV, Debt/EBITDA |

| Swiss Prime Site | Diversified | Europe | IFRS | LTV, Debt/EBITDA |

| AB Sagax | Industrial | Europe | IFRS | LTV, Debt/EBITDA |

| Gecina | Office | Europe | IFRS | LTV |

| CPI Property Group | Diversified | Europe | IFRS | LTV, Debt/EBITDA |

| PSP Swiss Property | Office | Europe | IFRS | Equity Ratio, LTV |

Surveying the largest REITs in each market reveals that the majority use the Debt/EBITDA ratio to assess leverage, and this metric is frequently discussed during earnings calls. U.S. GAAP reporting companies also utilize Debt to Total Market Capitalization, which incorporates the market price of equity. For example, we saw this calculation in the quarterly package of Realty Income Corporation:

Some REITs additionally calculate Debt to Assets, where the asset value is determined using a constant capitalization rate that is intended to match the type and risk profile of the assets. This cap rate remains fixed over time, meaning the resulting asset value may not always reflect current market conditions but does offer consistency and stability in calculations. For example, following is an excerpt from the quarterly package of Simon Property Group:

IFRS reporting companies, on the other hand, often use the Loan-to-Value (LTV) ratio, relying on asset values from the balance sheet that are regularly updated through appraisals. We saw this excerpt from the quarterly report of Vonovia, which calculates both LTV and Debt/EBITDA:

How Credit Rating Agencies View REIT Leverage

Credit rating agencies such as Moody’s and Standard & Poor’s (S&P) employ a combination of quantitative leverage metrics and qualitative assessments to evaluate REIT leverage. This leverage ratio analysis by credit rating agencies provides a comprehensive view of the financial health of REITs. Their methodologies reflect a balance between assessing operational efficiency, asset quality, and financial resilience, providing crucial insights into the risk profile, creditworthiness, and overall financial health of a REIT.

- Debt/EBITDA: This ratio assesses a REIT’s operational leverage by evaluating its ability to generate earnings relative to its debt obligations. A lower Debt/EBITDA ratio indicates stronger debt-servicing capabilities. Credit rating agencies often adjust this metric to account for non-recurring income or expenses, ensuring it accurately reflects core earnings potential. Moody’s generally considers a Net Debt/EBITDA below 4x to be strong for investment-grade ratings, while S&P regards Debt/EBITDA below 6x as indicative of good financial health. S&P also considers a ratio between 7.5x and 9.5x to be significant but manageable, depending on other factors such as asset quality.

- Debt/Total Assets or Loan-to-Value (LTV): These asset value-based metrics provide insight into the proportion of a REIT’s assets financed through debt. A lower LTV ratio suggests that the REIT has a substantial cushion between asset values and outstanding debt, reducing credit risk. Moody’s considers LTV ratios a core measure for evaluating asset risk and leverage, whereas S&P’s methodology adjusts LTV based on asset quality. Higher quality assets, such as multifamily properties with stable occupancy rates, may receive a more favorable assessment compared to riskier asset classes like retail or office properties. For example, while Moody’s uses Total Debt plus Preferred Stock/Gross Assets to measure leverage, S&P employs Debt to Debt plus Equity ratios, incorporating considerations like deferred taxes. Additionally, for U.S. GAAP reporting companies, S&P uses the undepreciated value of assets for the calculation.

- Fixed-Charge Coverage Ratios (FCCR): Moody’s and S&P both emphasize the importance of fixed-charge coverage. This ratio measures the ability of a REIT to cover fixed obligations such as interest and preferred dividends. Moody’s considers an FCCR greater than 2.5x as a strong indicator of financial resilience, while S&P considers anything above 3.1x to indicate robust leverage management. Ratios below 1.3x are viewed as a sign of high leverage risk.

- Consideration of Asset Quality: Asset quality is a crucial qualitative factor in credit ratings. Moody’s and S&P both evaluate the quality of assets held by a REIT, considering aspects such as property location, tenant profiles, and stability of cash flows. Higher quality assets—such as properties in prime locations with stable, long-term tenant commitments—tend to lower a REIT’s risk profile, which can offset the effects of higher leverage. For instance, a REIT with high-quality assets but a relatively high Debt/EBITDA ratio may still receive a favorable rating if its asset base demonstrates stable, long-term cash flow potential.

Credit rating agencies use these metrics and qualitative assessments in combination to form a holistic view of a REIT’s leverage and financial stability. The interplay between asset quality, debt structure, and operational cash flows is key to understanding the risk profile of a REIT. Moody’s often emphasizes strong fixed-charge coverage and a lower reliance on secured debt, whereas S&P places significant importance on asset quality and leverage ratios that reflect operational stability. In general, lower leverage ratios, stronger debt-servicing capabilities, and high-quality assets contribute to higher credit ratings and better financial resilience for REITs.

Academic Perspectives on REIT Leverage

Academic research on REIT leverage has explored various aspects of how leverage decisions are made and the impact of leverage on financial performance. A consistent theme across studies is the unique regulatory and capital structure characteristics of REITs, which differentiate them from other firms.

Leverage and Returns: Giacomini, Ling, and Naranjo (2014) examined leverage effects across public real estate markets in eight countries (both IFRS and U.S. GAAP reporting) and found a significant relationship between leverage and returns. The research suggests that leverage positively influences returns but also increases the risks during market downturns, such as the 2007-2008 financial crisis. This finding underlines the dual impact of leverage, where it can amplify returns in good times but also exacerbate losses during adverse conditions.

In this study, leverage was calculated using the Debt/Total Assets ratio. Total Assets were calculated as the book value of Debt plus the market value of the Equity. By this, the value of deferred taxes is incorporated in the calculation, since it’s reflected in the market value of equity.

Determinants of Leverage: Harrison, Panasian, and Seiler (2011) analyzed determinants of REIT leverage from 1990 to 2008. They found that asset tangibility positively correlates with leverage, whereas profitability and market-to-book ratios are negatively related. These relationships align with broader capital structure theories, such as the trade-off theory, which suggests firms balance the benefits of debt with the potential costs of financial distress. However, REIT-specific regulations, such as mandatory high dividend payouts, often limit the applicability of these general theories.

Leverage in this study was measured using Loan-to-Value (LTV) ratios and Debt/Equity ratios, with LTV providing a measure of the extent to which a REIT’s properties are financed by debt, and Debt/Equity indicating the proportion of funding coming from debt versus equity. For U.S. GAAP reporting companies, the study primarily used the book value of equity. As asset values are reported at historical cost under GAAP, This approach may not fully capture the current market value of assets, potentially understating leverage compared to IFRS reporting firms.

Market-to-Book Ratio and Leverage: Feng, Ghosh, and Sirmans (2007) explored the relationship between market-to-book ratios and leverage in REITs, finding that REITs with high market-to-book ratios tend to have persistently high leverage. This is contrary to the typical behavior of non-regulated firms and highlights the impact of REIT-specific regulatory environments on capital structure decisions.

In this study, leverage was primarily measured using Debt/Equity and Debt/Capitalization ratios, using the market value of equity rather than the book value. This approach provides insights into how market valuations impact a REIT’s financing decisions, ensuring that the leverage calculation reflects current investor sentiment and market conditions.

Asset Liquidation Value: Giambona, Harding, and Sirmans (2008) tested the Shleifer-Vishny hypothesis regarding asset liquidation values and found that REITs with more liquid assets tend to use higher leverage. The research supports the idea that asset liquidity plays a crucial role in determining the level of leverage that REITs are willing to undertake, as more liquid assets can be used as better collateral for debt.

Leverage in this study was calculated using Debt/EBITDA ratios and Debt to Total Assets, which provide insight into how REITs utilize debt relative to their operational income and asset base. The study primarily used the book value of equity for U.S. GAAP reporting companies, as GAAP accounting rules often require historical cost accounting, which may not fully reflect current market conditions.

Leverage in Different Property Segments: Nguyen (2019) examined the difference in leverage across REITs and non-real estate firms. The findings indicated that leverage differences between these sectors are driven primarily by the risk characteristics of tangible assets and differences in capital structure determinants such as debt costs. Specifically, the study noted that the REIT debt puzzle—the higher average leverage ratios of REITs despite their tax-exempt status—can largely be attributed to the value-based characteristics of their assets.

In this study, leverage was measured using Debt to Market Value of Assets, using the market value of equity, allowing for a comparison of leverage levels between REITs and other firms. This approach ensures that leverage calculations reflect the current market conditions and provide a more accurate assessment of financial risk.

Target Leverage and Market Timing: Ooi, Ong, and Li (2008) analyzed how REITs balance target leverage with market timing in their financing decisions. They found that REITs often deviate from their target leverage to take advantage of favorable capital market conditions. Despite the deviations, REITs tend to move back towards their target leverage over time, suggesting that target leverage still plays an important role in financing decisions.

Leverage in this study was calculated using Debt/Equity and Debt/Total Capital ratios, using the book value of equity rather than the market value.

Summary of Leverage Calculation Methods

| Study | Authors | Leverage Calculation Method | Value Type Used |

|---|---|---|---|

| Leverage and Returns | Giacomini, Ling, Naranjo | Debt/Total Assets | Market value of equity |

| Determinants of Leverage | Harrison, Panasian, Seiler | Loan-to-Value (LTV), Debt/Equity | Book value of equity |

| Market-to-Book Ratio and Leverage | Feng, Ghosh, Sirmans | Debt/Equity, Debt/Capitalization | Market value of equity |

| Asset Liquidation Value | Giambona, Harding, Sirmans | Debt/EBITDA, Debt to Total Assets | Book value of equity |

| Leverage in Different Segments | Nguyen | Debt to Market Value of Assets | Market value of equity |

| Target Leverage and Market Timing | Ooi, Ong, Li | Debt/Equity, Debt/Total Capital | Book value of equity |

In examining the leverage calculation methods used across different studies, it becomes clear that both market and book values have distinct roles in determining leverage ratios. Studies that focus on current market sentiment, such as Feng, Ghosh, and Sirmans (2007) and Nguyen (2019), often use the market value of equity to ensure that the leverage calculations reflect up-to-date asset valuations and investor perceptions. This approach provides a more dynamic understanding of financial risk, as market values can fluctuate with economic conditions.

On the other hand, studies like Harrison, Panasian, and Seiler (2011), as well as Giambona, Harding, and Sirmans (2008), rely on the book value of equity, which aligns more closely with historical cost accounting principles, particularly for U.S. GAAP reporting companies. Using the book value provides a stable and consistent measure of leverage, albeit one that may not fully capture current market dynamics. The use of book value is advantageous for understanding long-term capital structure but may understate or overstate leverage if market conditions have shifted significantly since the assets were initially recorded.

Ultimately, the choice between market and book values in leverage calculations depends on the specific objectives of the analysis. Market values are preferred for capturing real-time risk assessments, while book values provide stability and a historical perspective. A nuanced approach, incorporating both values where applicable, can offer a comprehensive understanding of a REIT’s financial leverage.

These studies provide a nuanced understanding of how leverage is managed within the REIT sector. They highlight the interplay between regulatory requirements, asset characteristics, and market conditions in shaping leverage decisions. The empirical evidence emphasizes that REITs operate under constraints that significantly impact their leverage strategies, leading to unique leverage patterns compared to non-regulated firms.

EPRA Guidelines on Measuring REIT Leverage

The European Public Real Estate Association (EPRA) has developed standardized guidelines for measuring REIT leverage to ensure transparency and comparability across companies. These guidelines help stakeholders understand leverage more consistently across different REITs, especially in the European context where reporting standards can vary.

- Net Debt / Total Property Value: This metric includes both the debt and the fair value of the properties, giving a clear measure of leverage that reflects current asset valuations. EPRA emphasizes using the fair value of properties to provide a more accurate assessment of leverage that aligns with market conditions.

- Proportional Consolidation: EPRA recommends proportional consolidation, meaning that the REIT’s share in joint ventures and associates should be included in leverage calculations to provide a comprehensive view. This ensures that the leverage ratio accounts for all assets and liabilities proportionally, giving stakeholders a true reflection of the REIT’s financial exposure.

- Consideration of Deferred Tax Liabilities: According to EPRA guidelines, deferred tax liabilities arising from asset revaluations should also be considered in leverage metrics, as they represent future potential obligations. Including deferred taxes provides a more complete picture of financial leverage, especially for equity holders interested in understanding potential claims on future cash flows.

- Consistency and Comparability: One of the key objectives of the EPRA guidelines is to enhance the consistency and comparability of leverage ratios across REITs. By setting clear standards for calculating metrics such as Net Debt/Total Property Value and ensuring proportional consolidation, EPRA aims to reduce discrepancies that arise from different accounting treatments or local practices. This makes it easier for investors to compare REITs operating in different regions or sectors.

The EPRA guidelines are especially important for ensuring that stakeholders, including investors and analysts, have access to leverage metrics that accurately reflect a REIT’s financial standing. By following these guidelines, REITs can present a clearer and more comparable picture of their leverage, supporting better-informed investment decisions.

REIT Leverage Constraints

Many REITs operate under leverage constraints, either self-imposed or regulatory, to maintain financial stability and meet credit rating requirements. These constraints help in managing risk, particularly during economic downturns, ensuring that leverage remains within acceptable limits.

- United States: There are no statutory or regulatory leverage limits for US REITs. But, U.S. REITs typically must maintain a minimum interest coverage ratio to avoid breaching loan covenants, which directly impacts how much leverage they can take on.

- Europe: European countries, particularly those in the EU, often have stricter regulatory frameworks for REIT leverage. In Germany, REITs must maintain equity of no less than 45% of assets, ensuring that leverage remains within a conservative range to mitigate financial risk. In Belgium, REITs are limited to a maximum of 65% debt relative to their assets, which helps prevent excessive leverage. These regulatory requirements help prevent over-leveraging, particularly in volatile property markets. Click here for a summary of European REIT regimes.

- United Kingdom: In the UK, REITs cannot be excessively geared by debt. They must maintain a profit financing ratio where the profits are at least 1.25 times the finance costs. This requirement ensures that REITs have sufficient earnings to cover their debt obligations, contributing to financial resilience and stability.

- Singapore: Singaporean REITs (S-REITs) are regulated by the Monetary Authority of Singapore (MAS), which imposes a statutory leverage limit. Currently, S-REITs are limited to a maximum gearing ratio of 50%. This cap was put in place to prevent excessive borrowing and ensure financial prudence in the relatively small and concentrated Singaporean property market.

These leverage constraints across various jurisdictions reflect different regulatory approaches aimed at ensuring the financial stability of REITs. They provide a safeguard against over-leveraging, which could lead to financial distress, especially during economic downturns or periods of declining property values.

Summary of Key Points on Measuring REIT Leverage

- Purpose of Leverage Calculation: Leverage calculations serve different purposes for debt holders and equity holders. Debt holders assess leverage to evaluate default risk, while equity holders assess leverage to gauge potential returns, cost of equity and financial risk.

- Asset Value-Based vs. Operating Ratios: Leverage can be measured using asset value-based methods like Loan-to-Value (LTV) or operational ratios like Debt/EBITDA. Asset value-based methods reflect leverage relative to the value of real estate assets, whereas operating ratios focus on income-generating ability.

- How CFOs Measure Leverage: CFOs of REITs often use book values for leverage calculations under IFRS, preferring the stability and reliability of appraised values. Under US GAAP, leverage metrics like Debt/EBITDA are often used, as they rely on financial statement accounts, which are less volatile than market values.

- Deferred Taxes: Deferred taxes play a significant role in leverage calculation, especially in IFRS reporting. Including deferred taxes provides a more comprehensive view of leverage, particularly important for equity holders interested in understanding potential future claims on cash flows.

- Credit Rating Agencies: Credit rating agencies like Moody’s and S&P use metrics such as Debt/EBITDA, Loan-to-Value (LTV), and Fixed-Charge Coverage Ratios to assess REIT leverage. A lower ratio indicates better financial health and lower leverage risk.

- EPRA Guidelines: The European Public Real Estate Association (EPRA) provides standardized guidelines to enhance the transparency and comparability of leverage ratios across REITs, emphasizing metrics like Net Debt/Total Property Value and proportional consolidation.

- Regulatory Constraints: Leverage constraints vary by country. These constraints are designed to maintain financial stability and reduce risk.

- Balancing Risk and Return: Academic research highlights the importance of balancing leverage to maximize returns while minimizing risks. Metrics such as LTV and Debt/EBITDA offer different perspectives, with each metric having unique advantages and limitations.

- Investor Considerations: Understanding leverage metrics is crucial for evaluating a REIT’s risk profile, return potential, and financial stability. Both asset value-based metrics and operational metrics should be used for a comprehensive analysis of a REIT’s leverage.

Disclaimer: The information provided in this post is for informational purposes only and reflects my personal opinions. It should not be considered as professional financial, legal, or investment advice. Please consult with a professional before making any investment decisions. I am not responsible for any actions taken based on this information. For more details, please refer to our full disclaimer.