Real Estate Investment Trusts (REITs) and Real Estate Companies are a popular way for people to invest in real estate without having to buy and manage properties directly. A Real Estate ETF (Exchange-Traded Fund) takes this concept even further by allowing investors to gain broad exposure to the real estate market without needing to pick and analyze individual companies.

In this article, we’ll explore real estate ETFs that focus on global real estate markets, excluding the U.S. We’ll discuss their features, benefits, and key considerations for investors.

What Are ETFs?

An ETF, or Exchange-Traded Fund, is an investment fund that holds a collection of assets—such as stocks or bonds—and trades on a stock exchange, just like individual stocks. Most ETFs aim to replicate the performance of an index, such as the S&P 500, and provide an efficient way to invest in a specific sector or asset class.

A Real Estate ETF focuses on real estate-related assets, such as REITs and real estate operating companies. These funds give investors exposure to a diverse portfolio of real estate holdings across various property types and regions.

Overview of Global ex-U.S. Real Estate ETFs

When it comes to global ex-U.S. real estate ETFs, there are four prominent options in the U.S. market, each with over $50 million in assets under management (AUM):

|

Two of those manage assets over $500 Million. You can read about the importance of the size of an ETF in the article: ETF Size Considerations. These ETFs track broad indices covering real estate markets outside the United States and include both REITs and operating real estate companies.

Unlike in the U.S., where REITs dominate, many global real estate companies operate without the REIT structure. This means these ETFs hold a mix of REITs and non-REIT real estate firms, providing comprehensive exposure to global real estate markets.

Expense Ratios: A Key Consideration

Expense ratios, or the fees charged by ETFs to manage their portfolios, vary significantly. Among these four ETFs, the two largest funds boast low expense ratios, while the smaller two charge much higher fees.

Since their holdings are largely similar, but the performance of the smaller ETFs does not surpass that of the largest ones, paying higher fees for the smaller ETFs doesn’t provide additional value. Generally, choosing an ETF with a low expense ratio is a smart move for maximizing long-term returns.

Diversification Across Sectors and Geographies

Global ex-U.S. real estate ETFs provide diversification by investing across multiple sectors, including residential, retail, office, industrial, healthcare, and more. While U.S. real estate companies often focus on specific sectors, many real estate companies in other countries own assets across multiple sectors. This distinction is less impactful when investing in broad ETFs, as they inherently provide multi-sector exposure—either by holding sector-focused companies or multi-sector companies.

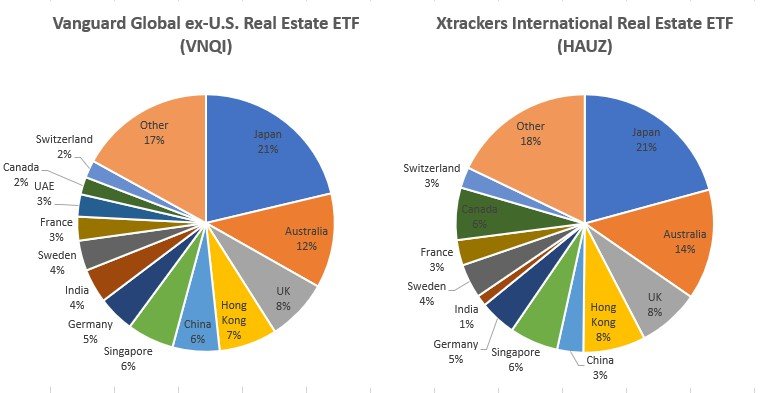

Geographically, these ETFs have substantial exposure to the Pacific region, with Japan, Australia, and Singapore collectively accounting for 40%-50% of the total holdings. Additionally, European countries represent approximately a quarter of the portfolios. The overall geographic diversification across these funds is quite similar, making it difficult to single out one ETF as significantly different than others. For example, following is the geographic diversification of the two largest ETFs, as of December 2024:

Performance and Historical Returns

Over the past decade, these ETFs have shown similar performance trends. The average ten-year returns reveal small variation between them, suggesting that differences in the indices they track are not significant.

Performance-wise, recent years have been challenging. Rising interest rates globally have increased borrowing costs and lowered commercial property values. As a result, the three-year average returns for these ETFs have been negative, around -6%. Looking at five-year averages, returns were approximately -3.6% annually, while the ten-year average hovered at 0.6%.

The Vanguard Global ex-U.S. Real Estate ETF (VNQI), the largest fund in this category, exemplifies this trend. Since its inception in 2010, VNQI has experienced both significant gains and losses, ranging from a 27% gain in 2017 to a -23% loss in 2022. Over a 13-year period, VNQI had five years with negative returns.

While recent performance has been underwhelming, the stabilization of interest rates suggests that future returns could improve compared to the past decade. Low historical returns might suggest undervaluation, but assessing the pricing of the real estate companies held by these ETFs is complex. Since these ETFs include both REITs and non-REITs, dividend distribution levels vary, making dividend yield comparisons less reliable. Additionally, net earnings under IFRS accounting standards include revaluation gains and losses, which make traditional pricing multiples like P/E less effective. Moreover, not all companies provide FFO or EPRA Earnings figures, further complicating the calculation of consistent pricing multiples.

Most of these ETFs predominantly hold companies reporting under IFRS, where balance sheet asset values are recorded at appraised levels. This makes book value a useful indicator of value. As of December 2014, VNQI reported an average P/B (Price to Book) ratio of 0.9, while RWX disclosed an average of 0.88, indicating that their holdings traded roughly 10% below book value. However, this does not necessarily signal undervaluation. Historical data shows that between 2002 and 2022, the average P/B ratio for European REITs was 0.89, as per EPRA market research, suggesting these valuations are typical. On the other hand, comparing current P/B ratios of the largest holdings to their 10-year averages reveals that many are now trading at lower multiples. This basic analysis highlights that while current pricing levels may seem attractive, a definite conclusion regarding undervaluation or overvaluation cannot be drawn.

Other Considerations

Tracking Error

Tracking error measures the difference between an ETF’s performance and the index it seeks to replicate. For most ETFs, this difference is minor.

Price to NAV and Bid/Ask Spreads

The price-to-NAV (Net Asset Value) spread indicates how closely an ETF’s market price aligns with its underlying asset value. The three largest ETFs in this category typically have minimal spreads, ensuring fair pricing for investors. You can check on the website of each fund its current NAV and the market price spread from NAV.

Bid/Ask spreads—the difference between what buyers are willing to pay and what sellers are asking, is usually very small for the largest ETFs. This minimizes transaction costs when buying or selling shares.

Conclusion

Global ex-U.S. real estate ETFs offer a straightforward and efficient way to invest in international real estate markets. With broad diversification across sectors and countries, these ETFs reduce risk while providing exposure to global property markets.

Among the options, the two largest ETFs—with their low expense ratios—stand out as the best choices for cost-conscious investors. While past returns have been lackluster, especially in recent years, historical performance should not be the sole predictor of future success. That being said, as of December 2024, it’s hard to say that the current pricing of the companies held by those ETFs indicates a bargain.

For investors seeking diversified real estate exposure beyond the U.S., global ex-U.S. real estate ETFs like VNQI are worth considering. As always, it’s essential to evaluate your investment goals and risk tolerance before making a decision.

Disclaimer: The information provided in this post is for informational purposes only and reflects my personal opinions. It should not be considered as professional financial, legal, or investment advice. Please consult with a professional before making any investment decisions. I am not responsible for any actions taken based on this information. For more details, please refer to our full disclaimer.