- Three Main Approaches to Real Estate Valuation

- Cap Rate: A Market-Driven Metric

- Market Sensitivity of Cap Rates

- Direct Capitalization vs. Discounted Cash Flow

- Degrees of Freedom and the Problem with DCF

- Why Cap Rates Often Make More Sense

- Industry Practices: CBRE vs. Newmark and C&W

- Cap Rate Advantage: A Pragmatic Approach

- Summary

Understanding the difference between cap rates and discount rates is crucial for real estate investors looking to make informed decisions. These valuation methods help determine the value of income-generating properties, assess the return potential, and manage risk. By mastering these approaches, investors can better evaluate opportunities and mitigate risks.

Real estate asset valuation/appraisal can be approached in multiple ways, and for seasoned professionals, understanding the nuances between cap rates and discount rates is critical. This article will delve into these key valuation methods, focusing on the cap rate approach versus the discounted cash flow (DCF) method, and why some valuation strategies are preferred over others.

Three Main Approaches to Real Estate Valuation

In practice, there are three primary approaches to valuing real estate:

- Sales Comparison Approach: This approach involves comparing the asset to similar properties that have sold recently. It’s essentially a market-driven assessment based on comparable transactions, useful primarily for residential and smaller commercial properties. For example, if several multifamily properties nearby were recently sold for a price range of 500-600$ per Net square foot, we could apply the same metric to our property.

- Direct Capitalization Approach: Direct capitalization is widely used for income-generating properties. It involves dividing the property’s net operating income (NOI) by the cap rate. The cap rate, derived from comparable market transactions, provides a straightforward estimate of value, assuming stabilized performance. For example, if comparable multifamily properties in the area have recently sold at cap rates between 5% and 5.5%, we can use that range to estimate the value of our property.

- Discounted Cash Flow (DCF) Approach: The DCF approach projects the property’s NOI over a holding period (typically 10 years) and adds a terminal value, representing the anticipated sale price at the end of the period. These future cash flows are then discounted back to present value using a discount rate. This method allows for a detailed cash flow analysis but also introduces additional complexity.

Cap Rate: A Market-Driven Metric

The cap rate is a fundamental tool in real estate valuation. It is calculated by dividing the property’s NOI by its current market value. For example, if a property has an annual NOI of $60,000 and a market value of $1 million, the cap rate would be 6%.

Cap rates indicate the expected rate of return on an investment, assuming stable performance. A higher cap rate typically suggests higher perceived risk, while a lower cap rate implies lower risk. Crucially, cap rates are observable from the market—investors can determine prevailing cap rates by analyzing comparable property transactions. This transparency makes cap rates particularly valuable for benchmarking and consistency in valuations.

Market Sensitivity of Cap Rates

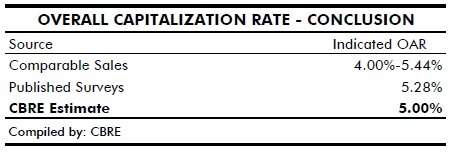

Cap rates are not static; they fluctuate with changes in market conditions. For instance, if the risk-free rate (such as government bond yields) increases or if investors demand a higher risk premium, cap rates will adjust to reflect these shifts. Thus, cap rates are sensitive to macroeconomic factors and investor sentiment, providing a direct link between valuation and market realities. For this reason, many appraisals not only conclude the cap rate based on market transactions, but also on recent surveys of market participants and bottom-up approach calculation, which updates the cap rate to the recent interest rate environment. For example, the following is the conclusion of the appropriate cap rate analysis for a multifamily asset in New Jersey, compiled by CBRE:

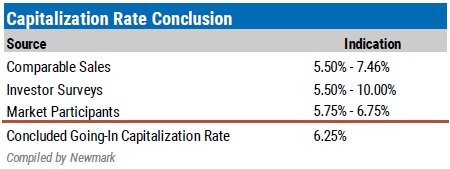

Or a retail asset in New York, compiled by Newmark:

Direct Capitalization vs. Discounted Cash Flow

| Method | Pros | Cons |

|---|---|---|

| Direct Capitalization | Simple, transparent, uses observable market data | Assumes stable future income, may lack precision for unique scenarios |

| Discounted Cash Flow | Detailed cash flow analysis, models various scenarios | Complex, relies on multiple assumptions, introduces variability |

In the direct capitalization approach, valuation is streamlined. By using the cap rate and current NOI, investors derive an implied property value, assuming relatively stable future income. This method works well for stabilized assets where future performance is predictable.

Discounted Cash Flow (DCF) analysis, on the other hand, requires forecasting NOI for each year over a defined holding period, along with estimating a terminal value using a terminal cap rate. These projected cash flows are discounted back to their present value using a discount rate, which reflects the required rate of return given the asset’s risk profile.

The DCF approach introduces added complexity. Often, the only significant variable change in these forecasts is related to rent and cost inflation. However, the assumptions regarding inflation rate, terminal cap rate, and discount rate are not directly observable. These factors introduce substantial variability, which can result in a broad range of possible valuation outcomes.

Degrees of Freedom and the Problem with DCF

The primary challenge with the DCF method is the number of assumptions involved. Estimating future inflation rates, terminal cap rates, and discount rates creates too many degrees of freedom, making it difficult to achieve a consensus valuation. These inputs are inherently uncertain and can vary significantly based on the analyst’s perspective. Also, the forecasting of cash flows in real estate usually does not add much value, since stabilization is expected after a few years.

In contrast, the direct capitalization approach relies on cap rates that are readily observable in the market, reducing subjectivity and ensuring a more consistent valuation framework. By focusing on current market conditions and avoiding speculative long-term projections, direct capitalization minimizes the risk of errors introduced by uncertain forecasts.

Why Cap Rates Often Make More Sense

For stabilized income-generating properties, the direct capitalization method is often the preferred approach. Since the cap rate is directly observable from market transactions, it provides a more reliable and transparent basis for valuation. It avoids the pitfalls of guessing future inflation rates or discount rates, which are inherently uncertain.

Consider an example: a shopping center in a secondary market generates an NOI of $200,000. If recent market data indicates that comparable assets are trading at a cap rate of 8%, the valuation is straightforward:

Value = NOI / Cap Rate = $200,000 / 0.08 = $2.5 million.

Using the DCF approach for this property would involve making numerous assumptions about rent growth, inflation, and exit values—each of which introduces uncertainty and potential inaccuracy.

Industry Practices: CBRE vs. Newmark and C&W

Industry practices vary significantly between firms. CBRE, for instance, tends to rely on sales comparison and direct capitalization approaches. This emphasis on observable data helps to ensure consistency and transparency in valuations.

Newmark and Cushman & Wakefield, on the other hand, employ all three approaches, including DCF. While this provides flexibility to model various scenarios, it also introduces greater variability in outcomes due to the subjective assumptions inherent in DCF analysis.

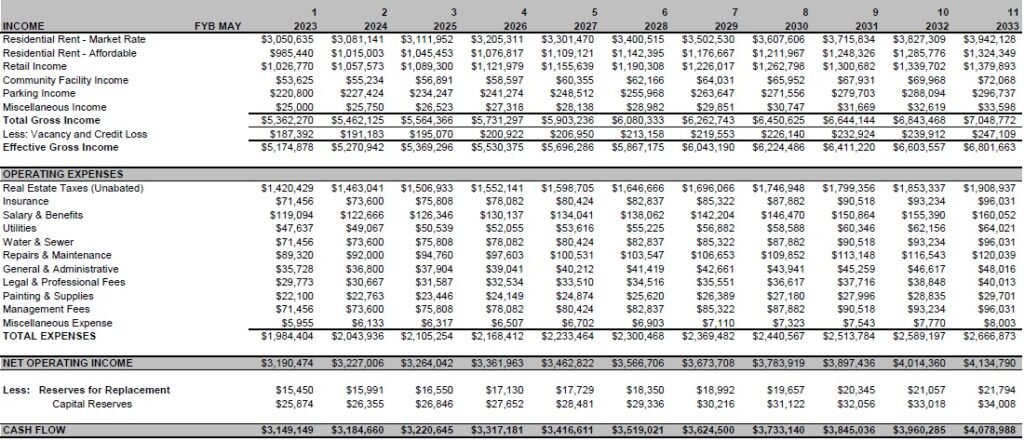

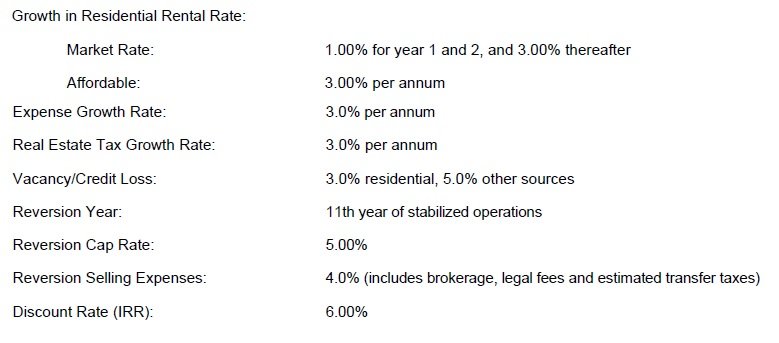

Following is a DCF forecast of a multifamily asset compiled by Cushman & Wakefield:

The NOI change is mostly due to inflation, as summarized in the assumptions list:

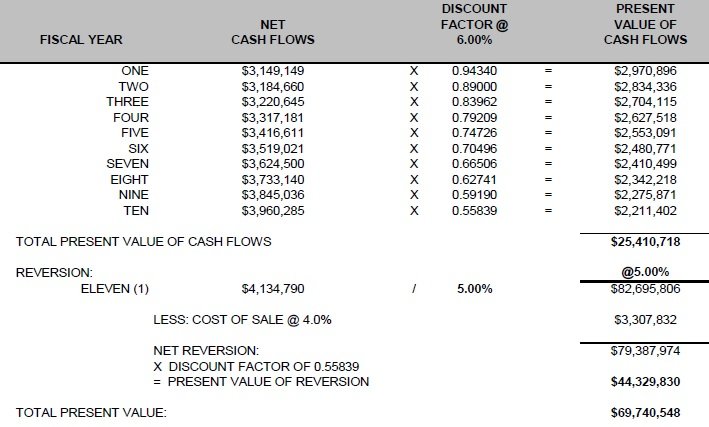

In the end, all those cashflows, and the terminal value, are discounted to present by using the selected discount rate:

Cap Rate Advantage: A Pragmatic Approach

In real estate investing, minimizing uncertainty is key. Since the cap rate is an observable metric, it provides a robust foundation for valuation, especially for stabilized properties. The added complexity of DCF often does not result in greater accuracy and can lead to significant variances depending on the assumptions made.

For most practical applications, particularly in markets where sufficient data exists, the direct capitalization approach is preferred. It is simple, transparent, and provides a valuation based on actual market behavior. This grounded approach allows investors to make informed decisions based on solid, observable data.

Summary

- Real estate valuations and appraisals are typically performed using one of three approaches: sales comparison, direct capitalization, or discounted cash flow (DCF).

- Cap Rate is a key metric in the direct capitalization method, calculated by dividing NOI by the property value, and it is directly observable from market transactions.

- Cap rates fluctuate based on changes in market conditions, such as shifts in the risk-free rate or changes in investor risk premiums.

- The DCF method involves projecting future NOI and terminal values, which are then discounted back to present value. This approach adds complexity due to the need for multiple assumptions (e.g., inflation rate, discount rate, terminal cap rate).

- The direct capitalization method is often preferred for stabilized properties due to its reliance on observable market data, reducing subjectivity.

- Degrees of freedom in the DCF method introduce a range of possible outcomes, making it less reliable compared to direct capitalization.

- Industry practices vary, with firms like CBRE favoring direct capitalization and sales comparison, while Newmark and Cushman & Wakefield use all three approaches.

- Direct capitalization offers a pragmatic and transparent approach to valuation, minimizing uncertainties and relying on market-derived cap rates.

- For stabilized assets, simpler valuation approaches like cap rates often yield more consistent and reliable results, avoiding the pitfalls of uncertain long-term forecasts.

Disclaimer: The information provided in this post is for informational purposes only and reflects my personal opinions. It should not be considered as professional financial, legal, or investment advice. Please consult with a professional before making any investment decisions. I am not responsible for any actions taken based on this information. For more details, please refer to our full disclaimer.